Is Bitcoin a speculative bubble?

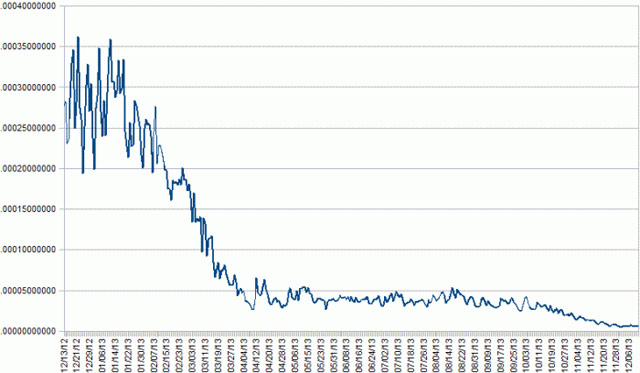

Bitcoin is a digital currency that has increased in value in US$ by 900% over the past six months. Jason Kuznicki says Bitcoin is definitely a speculative bubble and has three graphs to illustrate his point. I found this one particularly interesting…it plots transactions vs. total Bitcoin market cap:

This chart shows a dramatic reduction in the total number of transactions, irrespective of size, per dollar of bitcoin’s market cap, from December 2012 — December 2013. In absolute terms, market cap has generally gone up, and the number of transactions has mostly just bounced around a lot. The total value of bitcoin is going up, but it’s mostly getting parked rather than being put to work. Apparently there just aren’t a lot of appealing ways to spend bitcoin, anecdotal news stories to the contrary notwithstanding.

Instead, an increasing amount of bitcoin’s putative value (as measured in USD) is being squirreled away by larger and larger miner-investors. It’s not fueling a diversifying, all-bitcoin economy: if it were, transactions would be keeping up with or even outpacing market cap, particularly if bitcoiners came to rely increasingly on bitcoins and decreasingly on dollars for day-to-day purchases. That’s very clearly not happening.

The Wire’s Omar Little once said to Marlo Stanfield, “Man, money ain’t got no owners, only spenders.” Bitcoin seems to have the opposite problem. (via mr)

Stay Connected